david vélez

David Vélez: Revolutionizing Banking with Nubank

Por um escritor misterioso

Atualizada- abril. 14, 2025

Learn about david vélez , the visionary founder and CEO of Nubank, a fintech company that is revolutionizing the banking industry in Latin America.

david vélez is a name that has become synonymous with innovation and disruption in the banking industry. As the founder and CEO of Nubank, a Brazilian fintech company, Vélez has been at the forefront of revolutionizing the way people bank in Latin America.

Born and raised in Colombia, Vélez had an early passion for technology and entrepreneurship. After completing his studies at Stanford University, he worked at various tech startups in the United States before deciding to return to Latin America to start his own venture.

In 2013, Vélez founded Nubank with the aim of providing a better banking experience for millions of people in Brazil, where traditional banks often come with high fees and poor customer service. Nubank started by offering a no-fee credit card that could be managed through a mobile app, eliminating the need for physical branches and paperwork.

The success of Nubank's credit card quickly gained attention and attracted millions of users. In just a few years, the company expanded its product offerings to include personal loans, savings accounts, and even a digital account for small businesses. Today, Nubank is valued at over $30 billion, making it one of the most valuable fintech companies in the world.

What sets Nubank apart from traditional banks is its commitment to user-centric design and cutting-edge technology. Vélez and his team have made it their mission to create a seamless and intuitive banking experience that puts the customer first. By leveraging artificial intelligence and machine learning, Nubank is able to offer personalized financial solutions and real-time insights to its users.

Another key aspect of Nubank's success is its focus on financial inclusion. In a region where a significant portion of the population is unbanked or underbanked, Nubank has made it a priority to provide accessible and affordable banking services to all. Through its mobile app, users can easily open an account, apply for credit, and manage their finances, all without the need for a physical branch or a long and complicated application process.

With its disruptive approach to banking, Nubank has not only transformed the way people manage their money but also challenged the traditional banking industry to adapt. As a result, many established banks in Latin America have been forced to improve their offerings and digital capabilities in order to stay competitive.

david vélez's vision and leadership have been instrumental in Nubank's success. He has been recognized as one of the most influential entrepreneurs in Latin America and has received numerous awards for his contributions to the fintech industry. Under his guidance, Nubank continues to grow and expand its reach, with plans to enter new markets in the future.

In conclusion, david vélez is a true trailblazer in the banking industry. Through Nubank, he has revolutionized the way people bank in Latin America, offering a customer-centric and technologically advanced alternative to traditional banks. With his vision and determination, Vélez has not only built a highly successful fintech company but also paved the way for a more inclusive and accessible financial system in the region.

Casa de Campo Real Estate - Villas, Homes, Rentals, and Condos for Sale

La Liga 2017-18 - Real Madrid vs Valencia CF Photograph by Boris

david vélez is a name that has become synonymous with innovation and disruption in the banking industry. As the founder and CEO of Nubank, a Brazilian fintech company, Vélez has been at the forefront of revolutionizing the way people bank in Latin America.

Born and raised in Colombia, Vélez had an early passion for technology and entrepreneurship. After completing his studies at Stanford University, he worked at various tech startups in the United States before deciding to return to Latin America to start his own venture.

In 2013, Vélez founded Nubank with the aim of providing a better banking experience for millions of people in Brazil, where traditional banks often come with high fees and poor customer service. Nubank started by offering a no-fee credit card that could be managed through a mobile app, eliminating the need for physical branches and paperwork.

The success of Nubank's credit card quickly gained attention and attracted millions of users. In just a few years, the company expanded its product offerings to include personal loans, savings accounts, and even a digital account for small businesses. Today, Nubank is valued at over $30 billion, making it one of the most valuable fintech companies in the world.

What sets Nubank apart from traditional banks is its commitment to user-centric design and cutting-edge technology. Vélez and his team have made it their mission to create a seamless and intuitive banking experience that puts the customer first. By leveraging artificial intelligence and machine learning, Nubank is able to offer personalized financial solutions and real-time insights to its users.

Another key aspect of Nubank's success is its focus on financial inclusion. In a region where a significant portion of the population is unbanked or underbanked, Nubank has made it a priority to provide accessible and affordable banking services to all. Through its mobile app, users can easily open an account, apply for credit, and manage their finances, all without the need for a physical branch or a long and complicated application process.

With its disruptive approach to banking, Nubank has not only transformed the way people manage their money but also challenged the traditional banking industry to adapt. As a result, many established banks in Latin America have been forced to improve their offerings and digital capabilities in order to stay competitive.

david vélez's vision and leadership have been instrumental in Nubank's success. He has been recognized as one of the most influential entrepreneurs in Latin America and has received numerous awards for his contributions to the fintech industry. Under his guidance, Nubank continues to grow and expand its reach, with plans to enter new markets in the future.

In conclusion, david vélez is a true trailblazer in the banking industry. Through Nubank, he has revolutionized the way people bank in Latin America, offering a customer-centric and technologically advanced alternative to traditional banks. With his vision and determination, Vélez has not only built a highly successful fintech company but also paved the way for a more inclusive and accessible financial system in the region.

Ventajas de invertir en una casa en un campo de golf - Casas Nuevas Aqui

Fenerbahçe, Galatasaray'a karşı seriyi bitirmek istiyor - Fenerbahçe Haberleri

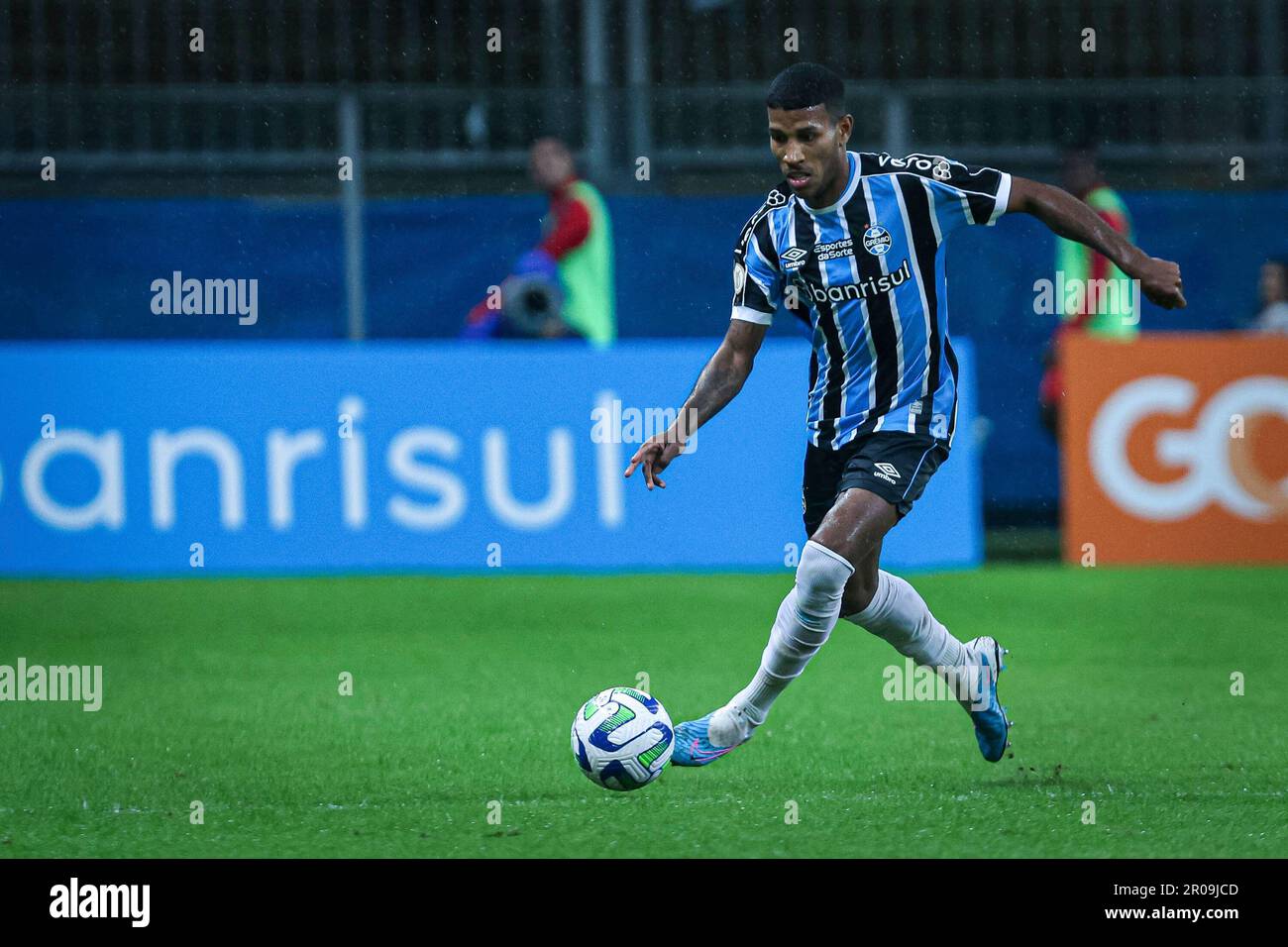

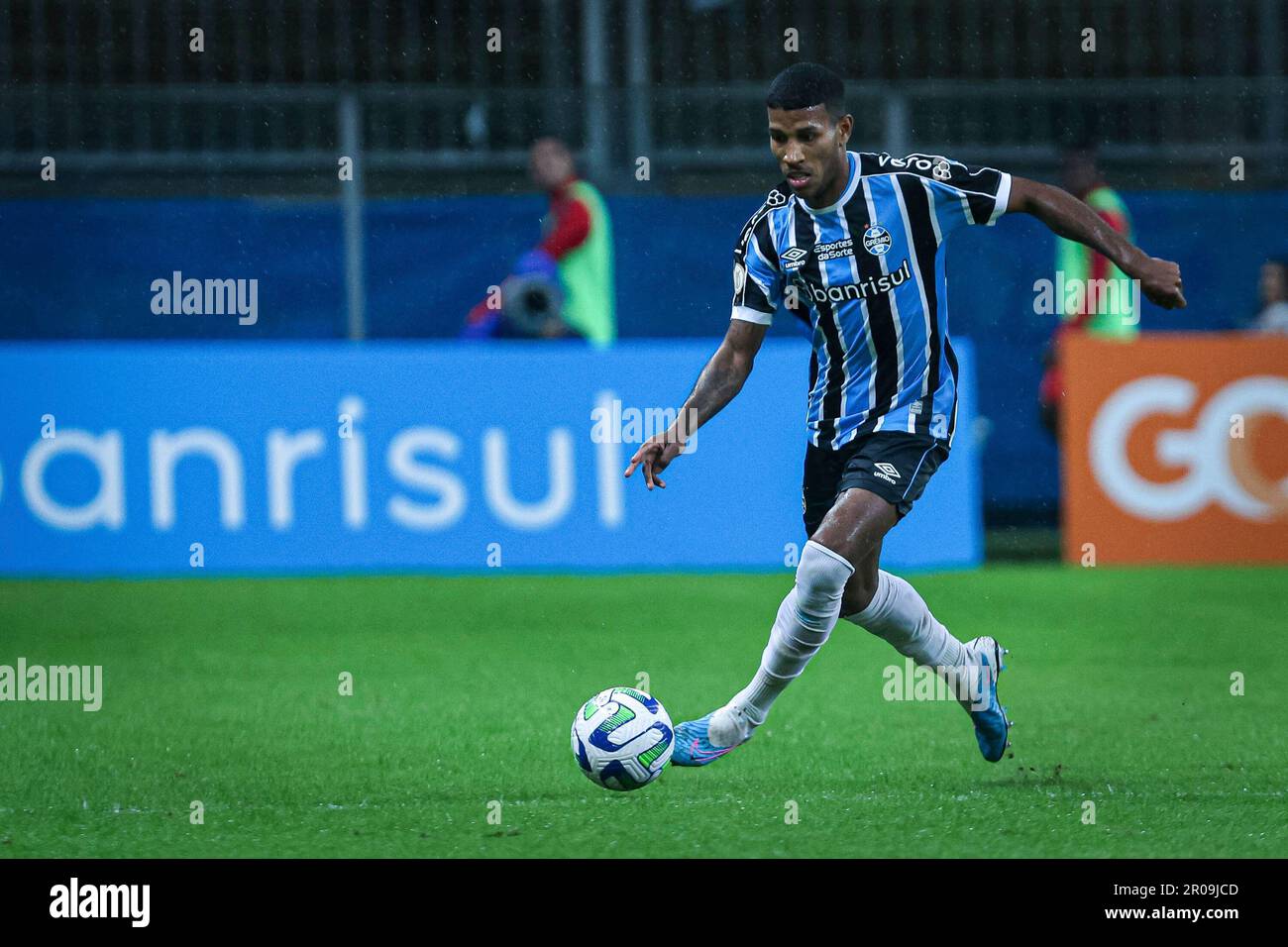

RS - PORTO ALEGRE - 05/07/2023 - BRAZILEIRO A 2023, GREMIO X BRAGANTINO - Thomas Luciano, a Gremio player during a match against Bragantino at the Arena do Gremio stadium for the

12 ideias de telhados para sua casa